Governance Essentials Highlights

Congratulations, you are a fiduciary! Now what?

Many people have placed their trust in your system to provide for their retirement security, and large amounts of money are involved. Now that you are responsible, how will you fulfill your duties?

The purpose of this Overview is to ask and answer some critical questions about governance, beginning with:

Who is a fiduciary?

What is governance?

Why is good governance so important?

What is the big picture?

What are the essentials?

Who needs to know?

When do you need to know these essentials?

How can it be tailored to your specific system and your individual needs?

How can you learn it quickly and put it to practical use immediately?

The goal is to equip you with timely, digestible information essential to your ability to perform as a fiduciary.

Let’s start with who is a fiduciary

You are probably either a part-time volunteer or a busy executive with a lot of demands on your time and attention

A fiduciary is responsible for managing the money of others in their best long-term interests and keeping promises that are largely made by others.

The discretionary powers of fiduciaries vary by jurisdiction. That’s why it’s essential you understand your duties and the powers you have been delegated.

Being a fiduciary is a significant responsibility.

As a public retirement system fiduciary, you are subject to the highest legal standard of care - higher than that of a corporate director.

Fiduciaries are always facing new hurdles. How prepared are you? Remember, there is no forgiveness period.

What protections do you have?

One of the best protections is to demonstrate prudence by adopting the Governance Essentials and asking insightful, critical questions.

Agreeing on how you will govern makes it more sustainable.

Board governance is a collective process

What are the key decisions?

Who gets to make them?

What information do fiduciaries need to make the best decisions under the circumstances?

How do those decisions get made?

How to demonstrate prudence?

A collective process takes more time to build consensus, but it is the best process we know.

Is there a common understanding of the process?

Is there a shared commitment to constructively engage?

Are fiduciaries willing to contribute to improved performance and rapid adaptation?

Are essential roles, responsibilities, relationships, and accountabilities clear?

Public retirement systems (with few exceptions) are governed by boards of fiduciaries (trustees) – elected, appointed, and ex officio.

There is a high potential for conflicts of interest.

That’s why the legal standard is so high

How will you and your co-fiduciaries manage those potential conflicts?

Whose interests do you represent?

To whom do you ultimately owe a duty of loyalty?

How will you govern?

“It's good to learn from your mistakes. It's better to learn from other people's mistakes.” - Warren Buffet

The 21st century has been characterized by sudden, major changes, extreme complexity, and uncertainty, and there are no signs of letting up anytime soon.

The outcomes are unknown, perhaps unknowable. In uncertainty, you need options – you don’t want to be left with no choices.

Options need to be in place in advance. What are the key decisions? Who gets to make them? How do they decide?

Good decision-making, that is, good governance, is critical to survival and successful adaptation in high uncertainty and rapidly changing conditions.

When it's working – governance is almost invisible. When it's not – it is painfully obvious.

Studies have shown good governance can improve investment performance by 1-3% annually.

Studies by Boston College and others have shown that good governance can improve investment performance by 1-3% annually.“Research suggests the impact of good governance may be as much as 100–300 basis points per year. . . . Almost all of our best-practice funds had a performance margin of 2 percent per annum or more over their benchmarks.”

What are the governance essentials?

There are many elements such as Purpose, Statutes, Rules, Prudence, Conflicts of interest, Ethics, Legislation, Regulations, Bylaws, Policy Manuals, Reporting, Composition, Duties, Powers, Fiduciaries, Executives/Sta^, Trustees, Investment, Third parties, Bylaws, Conflicts of interest and concepts such as “prudent,” “impartial” and “standards of conduct”.

Unfortunately, most systems’ governing documents are not organized in a consistent and easy-to-understand way.

Most of the time, they are a patchwork, developed over time, numerically organized—a legacy but typically without a unifying structure and usually requiring extensive interpretation by your executive director and legal counsel.

All the rules, regulations, policies, and procedures can be confusing and tangled like a thousand puzzle pieces without the cover picture on the box.

To make it more difficult, they keep moving and changing.

There are also a lot of conflicting opinions floating around about what is essential and where they fit.

New trustees often say they feel like they are drinking from a fire hose.

It can take two or more years to learn these essentials and see how they fit together.

What if there was an easier way?

All fiduciaries need to have a common understanding of the Essentials

As mentioned earlier, new trustees can feel like they are drinking from a fire hose, so they need a way to put everything in context.

Experienced trustees also need to know the Essentials because the system’s circumstances are constantly changing, and new fiduciary hurdles are constantly being introduced.

The environment doesn’t remain static, and all fiduciaries need to stay up to date with peer practices – it’s one of the fundamental expectations for being prudent

It is also important for executives with frequent board contact and those on the rise – because an in-depth knowledge of governance is essential to their career path.

Think of it like the picture of the assembled puzzle on the front of the box.

As fiduciaries, you need to maintain the big picture and focus on what's vitally important and not lose sight of the forest for the trees. It provides the context.

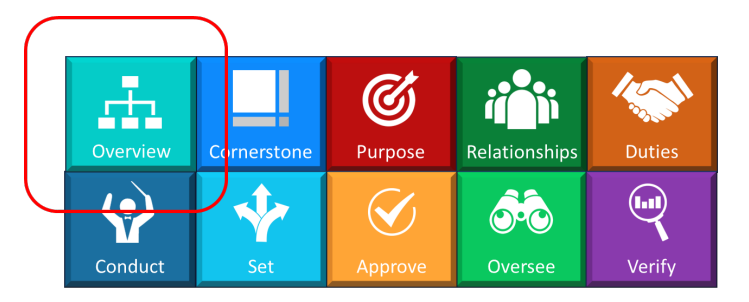

That’s why you need a reference point – a way to navigate. So, based on our experience, we’ve identified governance essentials that help to make all of these puzzle pieces easier to understand. We have organized them into a simple and easy-to-understand framework.

Cornerstone Documents. It begins with your system's cornerstone governance documents. Everything is built on these core documents. Your Cornerstone defines your system's purpose, the composition of the board, its terms, its qualifications, the powers reserved for the jurisdiction, and those delegated to the board. It also defines your system’s vital functions, such as investments, defined benefits, insurance, and defined contributions.

These retirement functions are what make public retirement systems unique. In addition, other enterprise functions, such as legal, HR, IT, finance, and accounting, are vital to enabling your systems' performance. These types of functions are common to most if not all, organizations.

Your cornerstone also defines your fiduciary duties in performing these functions. Essentially, these are the duties of loyalty, care, and compliance with the laws and plan documents.

Your cornerstone also defines the powers of your board to fulfill these duties.

Powers of the Board. There are five essential board responsibilities and powers.

First, the power to conduct the business of the board and its committees.

Second, the power to set direction and policy.

Third, the power to approve certain key decisions and prudently delegate authority to others.

Fourth, is the power to oversee the execution of direction within policy.

Fifth, is the power to verify the reliability of the information and advice received and reported to others.

Lastly, of course, all of this is built on relationships with your executives, staff, key stakeholders, and third parties that you work with.

So, who needs to know these essentials?

Lay boards are, by definition, not experts. They sometimes get criticized for this, although some boards, especially dedicated investment boards, tend to have more expertise.

But even if you are an expert, you don’t have time, and managing the system and its assets is not your job.

What critical questions should you ask yourselves and others to gain insight? If you don't know, ask your expert advisors for help.

And that’s what we have done!

We asked our network of nationally recognized experts to identify the critical questions that fiduciaries should always ask of themselves and others.

These questions are based on our experience conducting governance reviews with many different public retirement systems of all sizes and circumstances, with combined assets under management of almost 3 trillion dollars.

We have also identified the lessons learned from peers to answer those questions about what’s leading, prevailing, and lagging practice.

One size fits one!

Everyone brings different backgrounds, experiences, and perspectives.

Like the image above shows – they are all ones but they are also all di^erent. This can also make it hard to get on the same page and to stay there when turnover is inevitable.